You learn by doing. Getting the opportunity to fully do a thing, versus even thinking you one day might be able to partially do a thing, it ain’t easy. But it’s all in your head, and you’re only ever going to learn by getting out of your head and starting.

Take Brent Donnelly, for example:

I remember after a month at Citi, saying, “Man, I feel like I learned more about markets in this one month than I did in 4 years of economics in business school.” And, it’s kind of an exaggeration, but I feel like what you learn in school is the scaffolding, but then “Why DO stocks *actually* go up and down?!” It’s not discounted cash flows, obviously…

Brent is a master scaffolding constructer, climber, and project completer. He has the unique ability to see the finished project (or business, or trade, or whatever) in advance, then reverse engineer a process for getting to the desired outcome.

It shows up in stories like the one above, where he’s figuring out he learned more in a month on the trading floor than he learned in school, but also, if you look for it, the same logic is kind of behind everything he talks about.

He wanted a Wall Street job so he figured out which school in Canada could get him closest based on his (finite) resources.

He got to Wall Street and realized it wasn’t quite the right path for him at the time, so he worked out how to get back to Canada and get to work on a movie idea.

When the movie didn’t quite pan out, he ended up pursuing an idea for a cartoon that ultimately ended up on national television.

And then he came back to finance, built a name and reputation (through his shared writing), made some profits, booked some losses (+ learned some lessons) along the way, and when all that no longer suited him, he started Spectra to consult, trade, and mentor people in the field—with all the scaffolding he could help set for others.

It’s one thing to see the scaffolding, it’s another to do something with it.

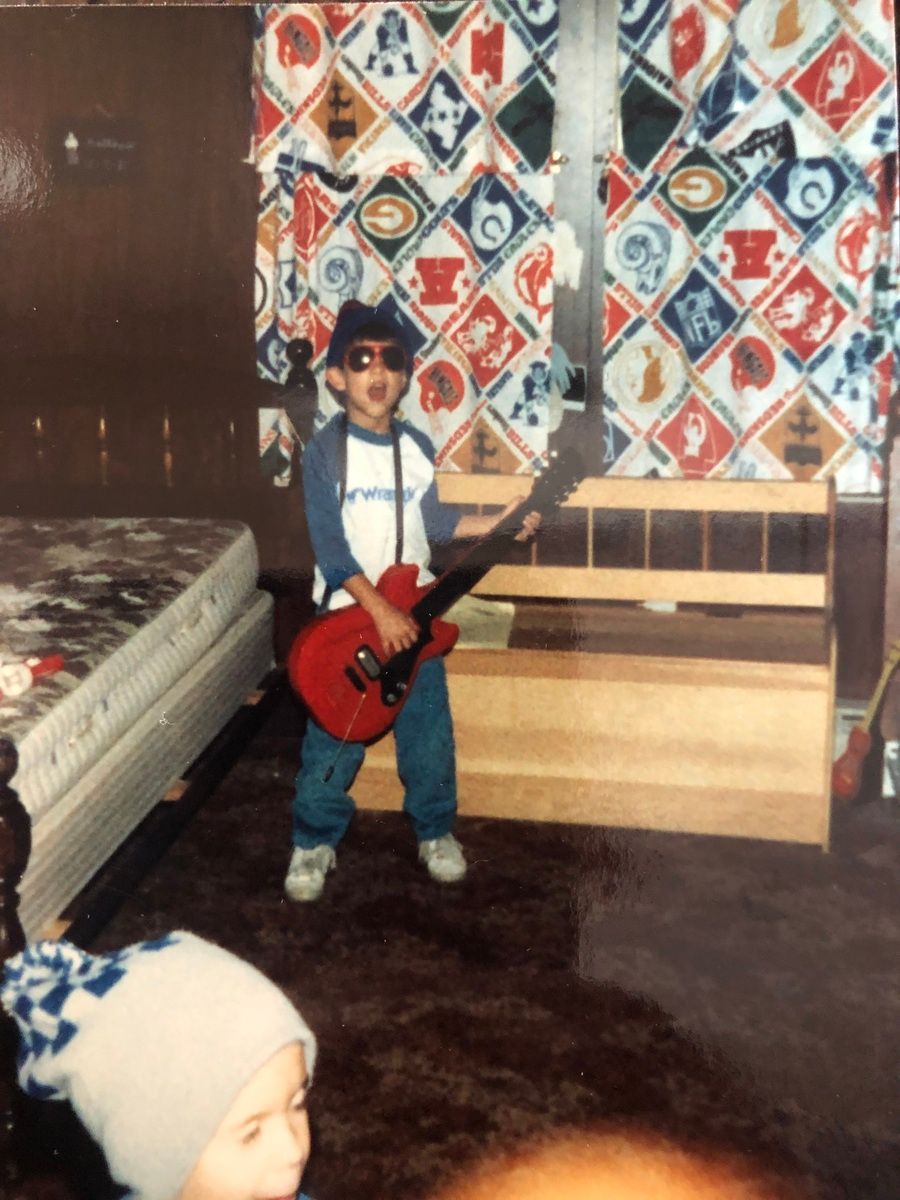

My personal theory? Brent learned how to storyboard strategy and follow-through on execution early in life. He did it intuitively at first, but then he honed it doing the cartoon. I’ll argue it’s even the entire premise of his 50 Trades in 50 Weeks book where he literally lays out trades as projects from starting scaffolding to finished reflections, all side by side, in complete formation.

When you get to hear Brent discuss the arc of his life and career so far though, when you hear him unpack his son’s Magic: The Gathering successes, or his draw to electronic dance music, or his appreciation for the black shirt he abandoned at an early ‘90s Pearl Jam concert only to have it mystically find its way back to him at a bus stop after the show, you start to realize how he sees, not just the potential parts of every sequence, but the room for surprise.

And as a trader, all he wants is to limit the downside surprise and maximize the upside—far, far, far beyond finance.

I enjoyed this talk so much. We had some great laughs along the way too. Come hang out with us, hear about his cartoon, his career, and (regrettably, far too few) Tragically Hip references!

PS. Choose your own adventure with Daft Planet, there are a ton of episodes on YouTube to make you feel all 2001 again, but at least indulge in the theme song and appreciate seeing Brent’s name flash by here: