For years, I've been connecting with interesting people and documenting insights that might help my clients and myself. What was once private is now (mostly) public.

People often ask: "How do you know all these people?" and "How do you connect these (re: random) ideas?" The answer is simple: consistent relationship cultivation and thoughtful note taking. My north star is trusting my instincts, my maps are the constellations in these reflections.

Find my Personal Archive on CultishCreative.com, watch me build a better Personal Network on the Cultish Creative YouTube channel, and follow me on social media (LinkedIn and X).

This approach has helped dozens of clients strengthen their networks and unlock new opportunities. You can:

Steal these ideas directly

Create your own combination that works for you

I can't promise you'll learn from me, but you'll definitely learn something with me. Let's go. Count it off: 1-2-3-4…

Do you know Brent Kochuba? Founder of Spot Gamma, options flow expert who turned market volatility into actionable insights? The man whose models appeared on NASDAQ's Times Square billboard and who built a thriving business analyzing gamma flows after the hedge fund he worked for collapsed during the COVID pandemic?

If not, allow me to introduce you. Brent has transformed technical market analysis into an accessible tool while helping traders understand the hidden drivers of market movement. I wanted to connect with him because he embodies something I value deeply: the ability to adapt to dramatic shifts in circumstance and create opportunity from adversity. Oh, and he can navigate the financial world without getting caught in the politics that consume so many careers. Mostly, or at least, he can do that now (but not so easily before, which, I just get it).

Our conversation is LIVE now on the Epsilon Theory YouTube channel (and this Cultish Creative Playlist, or wherever you get your podcasts). Listen and you'll hear how he navigated the path from network administrator to Spot Gamma founder and how options flow analysis has transformed his market understandings.

In the meantime, I wanted to pull THREE KEY LESSONS from my time with Brent to share with you (and drop into my Personal Archive).

Read on and you'll find a quote with a lesson and a reflection you can Take to work with you, Bring home with you, and Leave behind with your legacy.

WORK: Recognize When Systems Are Changing

"College [for me] is like [19]98… What was fascinating to me, looking back, is through all of my computer courses and technology core, no one ever was like, ‘The internet is gonna be this thing that runs our lives.’"

Key Concept: Major technological and market shifts often happen without institutional recognition. By developing your own perspective on emerging trends rather than relying on established institutions to interpret them for you, you can position yourself ahead of inevitable changes and capitalize on them.

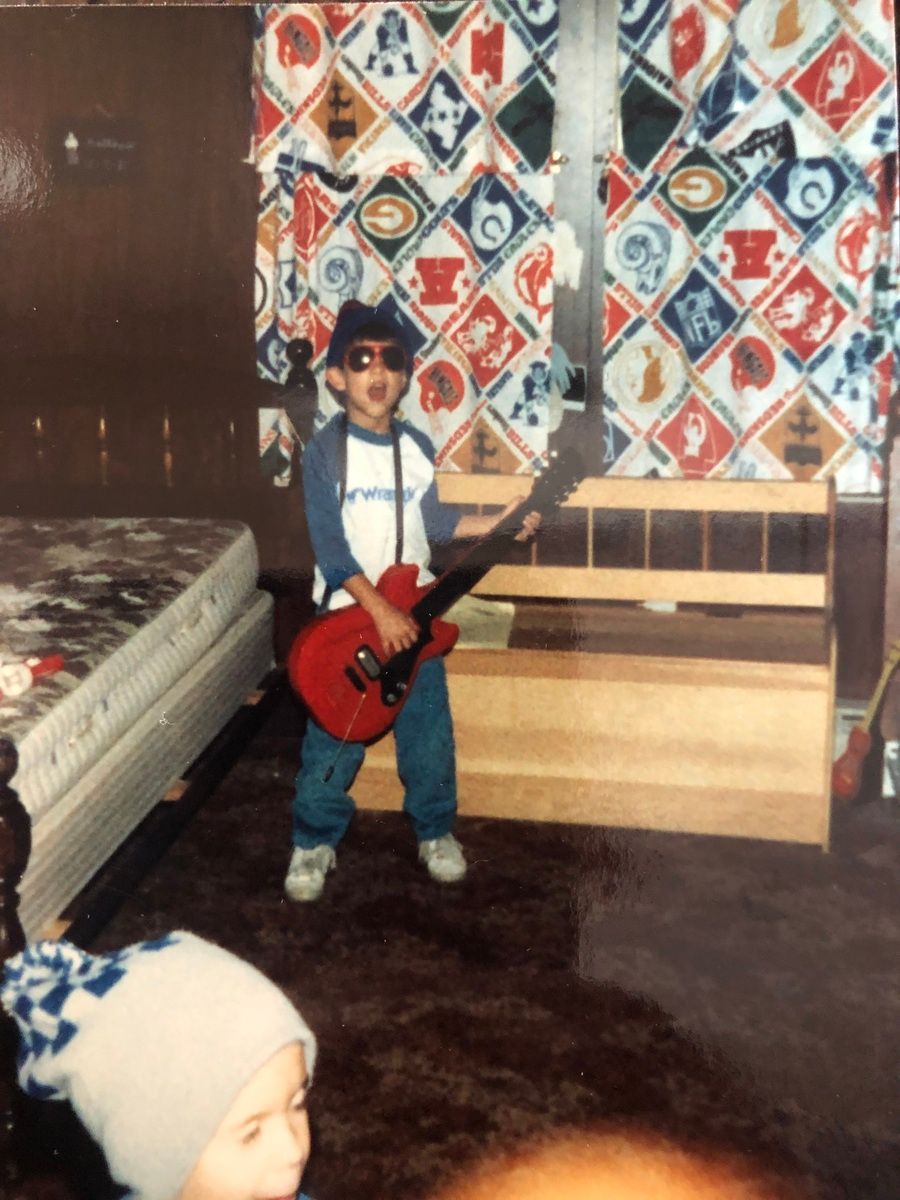

Personal Archive Note-To-Self: I didn’t understand how the internet was changing the whole music industry and/or the recording studio business I was so desperate to work in during the late 90s/early 2000s. We kind of talked about it in school, but mostly in the smaller risk senses, and never (or at least not blatantly enough for knucklehead me) in the DO YOU SEE HOW BIG THIS OPPORTUNITY IS way.

I get it and I know it’s hard in real time, but. Just think of the trends you could have gotten on top of by avoiding what the institutions were concerned with. My friends and I have somberly joked, had we just pursued more video and early social/YouTube distribution, where could we be today? Also, per Brent’s further comments, there’s no way this isn’t going on right now too, so what can you do to not miss an opportunity the institutions will get wrong right now (AI, I’m looking at you)?

Work question for you: What emerging trend are you seeing in your industry that established institutions aren't acknowledging yet, and how could you position yourself to benefit from being early to recognize it?

LIFE: Stay Close to What You Love

"You just love that. And like, you don't ever wanna move away from trading even though your role may change or whatever. It's just this fascination with markets that I think is... there's a lot of people that have that, it's like, I gotta be near that. I could do a bunch of things, but as long as I can reach out and touch that aspect of it, then I'm kind of good."

Key Concept: Career pivots are inevitable, but staying connected to what genuinely fascinates you provides continuity and purpose through transitions. When you maintain proximity to what energizes you, even radical career changes become evolutionary rather than disruptive.

Personal Archive Note-To-Self: I have to be writing. I have to be creating. I have to be doing something that scratches some original spin on this self-reflecting because I’m making it my own output or nothing will stick. It’s sort of the Feynman “you have to teach it to truly know you’ve learned it” idea at a whole other scale. Brent did it with trading, and I feel like I’ve always done it with writing. If I can write it down and share it, for feedback, I know I’ll be ok.

Life Question For You: What's the underlying fascination that has remained consistent for you even as your career has evolved, and how could you bring it more centrally into your work going forward?

LEGACY: Build Something People Want (Bonus Points If It Makes Markets More Transparent Too!)

"I had built all of these models like dealer gamma models... I was only trading S&P index options through that entire period... I saw day in and day out exactly how this moved. You know, big pockets of open interest would control things... I had posted some of my internal models with Gamma Curves and people were like, 'if you could give this to me every day, I would pay you.' And I was like, alright, I'll try it out... and that was the start of the Spot Gamma."

Key Concept: Markets work better with greater transparency. By democratizing complex market dynamics that were previously only visible to insiders, Brent was able to create value for others while building something lasting that improves the system for everyone.

Personal Archive Note-To-Self: The most impactful work often comes from sharing insights that others keep private. You can’t hoard it and even if you share it - some people will criticize you. It’s inevitable. But every time I’ve shared too much about how something is done, you know what I’ve realized? Almost nobody copies me. If it’s really great, it inspires others to ask, “Hey, can you do that for me?”

Part of it is that fact that people are lazy. But the more important part of it is sharing matters. Your instincts make you you. So, you’re accumulated knowledge is you being you and what gets stored up over time. That has value. That’s worth sharing, and it’s not worth being scared about letting some industry secret out.

Legacy question for you: What insight or understanding do you have that most people in your field don't recognize yet, and how might sharing it create both immediate value and lasting impact?

BEFORE YOU GO: Be sure to…

Connect with Brent Kochuba on X at @spotgamma or via his other socials

Check out Spot Gamma's market analysis at spotgamma.com

Listen to his monthly options updates on the Excess Returns podcast (The OPEX Effect)

And, take a moment to reflect on all these ideas!

Remember, you have a Personal Network and a Personal Archive just waiting for you to build them up stronger. Look at your work, look at your life, and look at your legacy - and then, start small in each category. Today it's one person and one reflection. Tomorrow? Who knows what connections you'll create.

Last thing: Don't forget to click reply/click here and tell me who you're adding to your network and why! Plus, if you already have your own Personal Archive too, let me know, I'm creating a database.