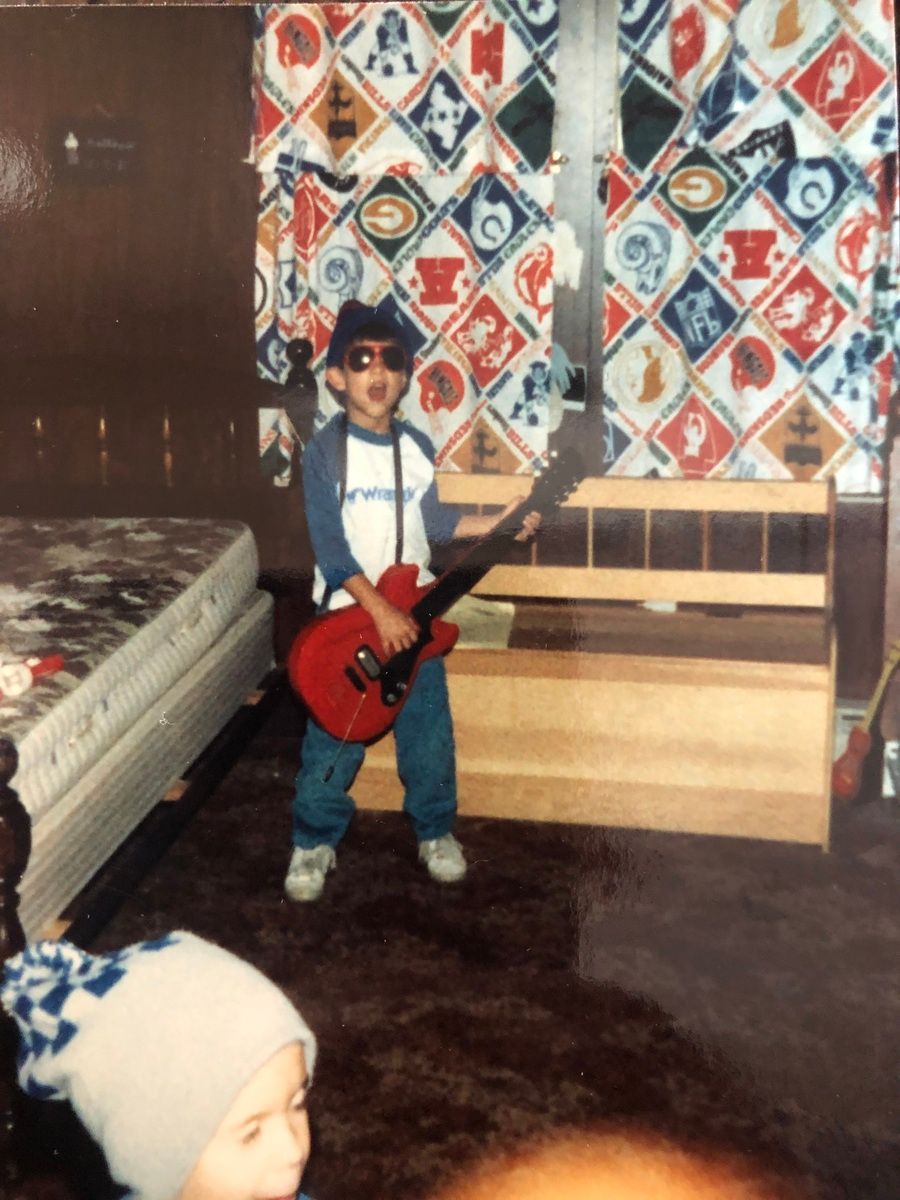

You start a band with your friends. You write some songs. You start to get some gigs. It's all fun and good. Then the Department of Labor calls you and demands to see your payroll, which you don't have, nor have you ever even imagined let alone considered, and you have your first mini (entrepreneurial) heart attack.

That happened to me.

Kind of reminds me of this old joke that goes (writer's note: I didn't say it was good or funny or even true, but I did say it's a joke, don't forget that please), "Marriage takes all the fun out of dating, and kids take all the fun out of marriage."

I've always thought the artistic corollary to that was even more valuable: "Business takes all the fun out of creativity, and a business getting big takes all the fun out of business."

The core ideas are similar, because they're like my band story. It starts off as fun. Then it gets serious, and if you follow the serious rule book, eventually it turns into just another job and you miss having fun like when you started out.

Is it any surprise most creative people don't end up in creative jobs? If you're reading Cultish Creative, you probably get this feeling too. There's something structurally amiss here, and us artistically-minded people need some help. Which is exactly the kind of structural mismatch Yancey Strickler is trying to solve (as if co-founding Kickstarter wasn't enough).

Artist Corporations vs. HoldCo Questions

When I first read about Yancey Strickler's Artist Corporation (A-Corp) idea, my financial planner brain immediately went: "Isn't this just a holding company with some LLCs underneath?" And honestly, that was my first reaction because that's exactly how I'd solve this problem today for a creative with multiple ownership structures and revenue streams - I'd work with the attorneys and accountants to set up some sort of a HoldCo structure and nest different projects under it.

But the more I've dug into this A-Corp idea, the more I think there's something genuinely different happening here. And it comes down to a question that's been nagging at me, because with every business structure, it's useful to think about what I call "the business consultant angle."

If we magic-wand A-Corps into existence for a moment, we have to remember, somewhere is a small- to middle-market management consultant who is going to think, "Why should artists get this structure, but not veterinarians with multiple practices?"

And that consultant has a very good (and very valuable) point.

Take a veterinarian with multiple practices who's building toward a private equity exit. They could use a traditional HoldCo (if it suits them), but even they run into the same structural limitations I'm about to describe. The difference is, they at least have a predictable timeline and business model.

Artists? Not so much.

Why Current Structures Break Down for Creatives

What do you do when the band has to figure out credits for writing the songs? What do you do when the band has to buy a van? What do you do when the label has a deal with side deals for certain members but not others? It gets complicated fast, and partly because it's inherently complex, but also because none of our current business structures are built for the fluid, collaborative, multi-project reality of creative work.

Here's where it gets really technical (and where my financial planner hat is definitely on): there's a fundamental limitation with traditional HoldCos that most people don't think about the way Yancey is thinking about it.

At the highest level, you can't really mix S-Corps and C-Corps in the same structure without losing the tax benefits that make each one valuable. Our hypothetical business consultant knows this deeply.

And before I go further, I need to clarify something else about Yancey's comparison table that bugs me as someone who looks at these structures regularly. He lists LLC, S-Corp, and C-Corp as if they're equivalent choices, but that's not quite right. An LLC is a legal entity structure - you form an LLC with your state. An S-Corp is a tax election - you choose to have your LLC (or corporation) taxed as an S-Corp by filing with the IRS. You can have an LLC that elects S-Corp tax treatment, which is actually pretty common.

The real choice is usually: LLC or Corporation for your legal structure, then how do you want the IRS to tax it? This distinction matters because it affects how you think about the flexibility A-Corps might offer.

Back to the core limitation: S-Corp tax treatment is great for high cash flow entities - it helps you reduce self-employment taxes when you're pulling money out regularly. C-Corp tax treatment is better for high sale value entities - because it sets you up for capital gains treatment when you eventually sell (and, as of now, long-term capital gains rates are in line with dividend rates, but lower than ordinary income rates, and… it's all about not paying unnecessary taxes, got it?).

Here's the big point the table isn't designed to construe: for each entity, you have to pick one tax treatment.

Even that veterinarian I mentioned faces this problem. They might want S-Corp treatment now for cash flow optimization on the core practice, but if they're building toward a private equity exit that would benefit from C-Corp structure, they have a question to answer. The truth of the matter is, they can't have both simultaneously - if you put S-Corps under a C-Corp holding company, the S-Corps lose their S-election, and therefore a giant tax shield. So they either accept double taxation on current distributions, or they do an expensive conversion process 3-5 years before the planned sale, losing years of S-Corp benefits, and it's a lot of work (and happily paid business consultants).

At least the vet has a predictable timeline and can plan the conversion. For artists, this limitation is a nightmare, from startup to exit. A new structure could serve this market better.

The Artist's Dilemma

Think about a working musician. Think how different this is from a vet's practice - and I'm not just talking about potential for compensation (but I also am thinking of that detail). The working musician might have:

Touring income that needs immediate cash flow optimization (S-Corp territory)

A publishing catalog that's building long-term value (C-Corp territory)

Collaborative projects with revenue splits that don't fit either model

Grant-funded community work that needs nonprofit treatment

Stack all that up, and there's even another broader layer that makes it even more complex: capital formation. Businesses that create cash flow right away can bootstrap - the vet clinic starts seeing patients and paying bills from day one. But creative projects often can't. You need funding upfront for recording an album, shooting a film, or developing a platform, with no guarantee of immediate revenue.

This is where multiple funding options and ownership structures become critical. You might need angel investment for one project, grant funding for another, and crowdfunding for a third. Each funding source comes with different expectations around governance, equity, and returns. With current structures, you're constantly choosing between optimizing for today's taxes, tomorrow's sale, or the governance needs of your current investors.

With current structures, you're setting up multiple entities with different tax elections, or you're leaving money on the table because you can't access the right structure for each revenue stream.

When you start to consider these scenarios, and remember that Yancey Strickler is the co-founder of Kickstarter, not to mention a business/podcast partner with visual artist and creator Joshua Citarella (I'm a huge fan of their New Creative Era podcast), and you can see where this A-Corp idea has emerged from.

Where A-Corps Get Interesting

If A-Corps can actually solve this flexibility problem - and I'm still skeptical about the mechanics¹ - that's not just convenient. That's a genuine breakthrough for people with unpredictable, multi-faceted creative careers.

The promise, as I understand it from Yancey's work, is that A-Corps could toggle between different tax treatments at the project level, or provide some hybrid approach that doesn't force these either/or decisions. Plus, they're designed around collective decision-making and shared prosperity in ways that traditional HoldCos just aren't.

It's not just about the tax benefits, though that's huge. It's about governance structures that assume collaboration rather than hierarchy². It's about equity sharing that can accommodate non-monetary contributors. It's about blending commercial and mission-driven work under one umbrella. And critically, it's about capital formation - being able to raise money from different sources (investors, grants, crowdfunding) without having to restructure your entire business every time you need a different type of funding³.

Fundamentally, Yancey is asserting, "Two wild assertions we can't 100% back up but pretty sure are true: (1) Art and creative expression have never been more present in society than today. (2) More people listen to, watch, and make creative work than ever before," and posing a structural solution. You can't be mad at him for trying.

What if (per the flow-chart in his post) I could have a contract consulting practice that S-corp style pays my salary, with dividends for what most would think of as bonuses, and a mechanism for expenses flowing into my creative work projects, with c-corp style ownership, so I could potentially raise additional money around them, and eventually sell them at the capital gains rate, all under one umbrella? If that could even have a chance of occurring, this deserves more work. So…

My Professional Skepticism (and Excitement)

Look, I work with attorneys and accountants regularly to help my clients think through business structures, and this S-Corp/C-Corp limitation trips up even sophisticated business owners. I have a lot of questions about how A-Corps would actually work in practice. How do you maintain different tax elections within one entity? How do you handle liability separation? What happens when collaborators want to exit or die or - because we're talking about artists here - want to change direction (i.e. the singer goes solo, the creative partner goes rogue, or the painter decides to make a movie)?

Even with all those questions, here's the thing - I'm living a variation of this problem right now. I have, effectively, 4 businesses I'm tied to in different ways, with different income streams, ownership structures, and expense profiles across the board (Sunpointe, Cultish Creative, Excess Returns, and Perscient/Epsilon Theory).

Some are cash-flow positive and would benefit from S-Corp treatment, but can't elect it due to professional practice restrictions (planning and investment firms can't file as S-Corps). Others are building long-term value (Cultish Creative is all downstream potential to me, but no ultimate sale value, whereas Excess Returns and Perscient could theoretically find buyers someday).

These are a mix of collaborative and solo projects. I only fully own one. Everything else is “complicated” in relationship-status terms. This is what being a modern artist looks like. The administrative headaches of managing the right structure for each, let alone how they combine for me, it's very real.

And I'm not even a "full-time" creative! I can't imagine trying to navigate this as a working artist with the additional complexity of grants, collaborations, and project-based work - though I do have clients in my planning practice who face exactly these challenges, and I can vouch for them, it's all incredibly difficult to optimize for.

What I know (so far) is that an A-Corp won’t solve my problem, but it might make a few layers less hard - namely Cultish Creative and Excess returns - where so much of the potential business model is downstream and collaborative from the start.

Why This Matters Beyond Structure

I think what Yancey is really getting at is bigger than just business formation. More people than ever consume art, but it's never been harder to earn a living wage as an artist. Part of the problem is structural - our legal and financial systems weren't built for how creative people actually work.

As Yancey argues in his note,

In a 2023 survey of Americans:

86% said arts and culture improved their community's quality of life

79% attended an artistic or cultural event in the past year

48% said they actively create: painting, making music, writing, crafting

Despite this, creative people still struggle to earn a living from their work:

85% of artists earn less than $25,000 a year (source)

13% of artists earn a full-time living from their practice (source)

If A-Corps can genuinely solve some of these structural disadvantages, that could change the game for creative careers. Not just making it easier to manage multiple projects, but making it more attractive for people to invest in creative work, collaborate on artistic projects, and build sustainable creative businesses.

We also need to box the creative arts out (or in?) here⁴. While the local vet definitely improves the community's quality of life, and everybody with a pet has to go once in a while, not to mention every pet owner is happy to show you pictures on their phone and tell you how they either love their vet or regret how much pet ownership costs… vets are good at getting paid.

I want to help build an industry where artists get compensated as well as vets do, without needing armies of consultants to figure it out. I'm raising my hand to help create that future. I think this is just as important as veterinarians and want to encourage as many creative practices as there are pet owners if I can!

The Bottom Line

I want to see more options like this. I think it will help people be more confident in starting creative businesses. I also think it will help put the myth that you can't make it as an artist to bed - because I think you can, it's just different from how it's been at other points in history.

Is A-Corp perfect? Probably not. Will it solve every problem? Definitely not. But if Yancey and his team can pull this off - and given his track record with Kickstarter, I'm not betting against him - it could be genuinely transformative for creative careers.

The world might be changing a little bit for the better here. Worth paying attention.

If you think this is for you, follow along at Artist Corporations. Get on the lists. Fill out the surveys. And if some of that Kickstarter magic takes hold here, we might really have some change on our hands.

I'm all for trying it.

Watch Yancey's TED Talk:

FOOTNOTES

1. The toggle between tax treatments at the project level is a big leap. The stacked A-corp structure might have to be more like a HoldCo (so other businesses don't decide this isn't fair, which is fair to argue) and that's just the reality where this faces a major lobbying challenge.

2. Governance and liability protections run hand in hand. Who makes what decisions with what interests in mind gets messy - we need a lot more scenarios on the table to prove this is smarter than the current set of structures.

3. The capital formation and exits of parts of an artistic enterprise, there are lots of examples here in the world (and law, and accounting histories) of Intellectual Property (IP), so merging those ideas with a new business structure will, again, require a lot more scenarios to analyze.

4. I know I picked on veterinarians, but it was only for a counter-example that everybody would be familiar with. The reality is - consultants, designers, freelancers, etc. all fall under this creative/artist category, with multi-entity, multi-revenue challenges, and they are very much outside more standard businesses (like our vets).

5. I do worry about pitfalls of making a new structure. It's already so complicated⁵. This has to make the world easier or more simple, and right now I'm unconvinced.