For years, I've been connecting with interesting people and documenting insights that might help my clients and myself. What was once private is now (mostly) public.

People often ask: "How do you know all these people?" and "How do you connect these (re: random) ideas?" The answer is simple: consistent relationship cultivation and thoughtful note taking. My north star is trusting my instincts, my maps are the constellations in these reflections.

Find my Personal Archive on CultishCreative.com, watch me build a better Personal Network on the Cultish Creative YouTube channel, and follow me on social media (LinkedIn and X).

This approach has helped dozens of clients strengthen their networks and unlock new opportunities. You can:

- Steal these ideas directly

- Hire me to implement them with you

- Create your own combination that works for you

I can't promise you'll learn from me, but you'll definitely learn something with me. Let's go. Count it off: 1-2-3-4…

Do you know Cullen Roche? He's a behavioral portfolio manager, macroeconomic thinker, and the founder of Disciplined Funds who has built a reputation for cutting through financial BS with evidence-based analysis.

If not, allow me to introduce you. Cullen evolved from selling whole life insurance products he couldn't believe in to running hedge funds to eventually creating disciplined, behaviorally-robust portfolios for retirees and other advisors. I wanted to connect with him because he embodies something I value deeply: the intellectual honesty to admit when he's wrong and the drive to create solutions rather than just critique what's broken.

Our conversation is LIVE now on the Just Press Record YouTube channel (and this Cultish Creative Playlist). Listen and you'll hear how investing is more like amateur tennis than professional sports, why forecasting is unavoidable but most predictions are entertainment, and how chickens and gardening teach patience better than any market strategy.

In the meantime, I wanted to pull THREE KEY LESSONS from my time with Cullen Roche to share with you (and drop into my Personal Archive).

Read on and you'll find a quote with a lesson and a reflection you can Take to work with you, Bring home with you, and Leave behind with your legacy.

WORK: Win By Not Losing - Master The Loser's Game

"Investing is a loser's game in the sense that it's the person who doesn't make the most mistakes wins. So you win by not losing, basically... it's the people that don't sell into bear markets. Those are the losers. Those are the people that lose the losers game because they make a big behavioral mistake in a somewhat frightening environment."

Key Concept: Unlike winner's games where superior performance determines victory, investing success comes primarily from avoiding catastrophic errors. The biggest mistakes - selling during market panics, paying excessive fees, taking unnecessary concentrated risks - often matter more than brilliant stock picks or market timing. This framework shifts focus from seeking home runs to building sustainable, long-term strategies.

Personal Archive Note-To-Self: In virtually every service business, I see the same problem all of the time - people talk about their value proposition, and their tech stack, and their fabulous track record, and, all sorts of other stuff. When, in reality, the entire success (or failure) of the business boils down to this: do people like talking to you? Do they like doing business with you? Does that relationship work mostly well (not even perfectly!) for them?

Everybody wants to be a hero. They want to make all the right decisions and get all the glory. The truth is, if you just can figure out a solid way to not screw up, then what’s left is to show up.

I know writing these posts isn’t my technical job. But, I also know that if I show up in people’s inboxes consistently, they’ll notice my consistency. They might worry about my stubbornness or OCD from time to time too, but even if I’m not changing their lives with incredible post after incredible post, showing up is not losing.

Showing up, consistently, because you love to do it, is how you win by not losing in most of life.

Work question for you: In your professional life, where are you trying to win a "winner's game" when you should be focused on not losing a "loser's game"? What big mistakes could you systematically avoid rather than chasing perfect execution?

LIFE: Embrace Predictions While Acknowledging Uncertainty

"I embrace the fact that you have to make predictions. And it's not that it's not that much different than, you know, coaching in the sense that you, you have to inevitably predict what is the other team gonna try to do over the course of the next few plays... There are smart ways to make forecasts and there are really stupid ways to make forecasts."

Key Concept: Rather than avoiding predictions entirely, Cullen advocates for making thoughtful, probabilistic forecasts based on evidence and time horizons. Life requires planning for uncertain futures - whether in financial planning, career decisions, or personal relationships. The key is distinguishing between necessary, well-reasoned forecasts and pure speculation disguised as analysis.

Personal Archive Note-To-Self: I almost asked if I could be honest but I’m talking to myself and my AI-editor here first so here goes - I have no time for the anti-prediction people. I have as little interest in them as I do for anyone who believes in exclusively “passive” anything. I live for the people who can say “I don’t know,” and still make a bet on what might happen next at work, in life, and yes, in markets.

If you’re not willing to be wrong in the face of not knowing, what are you hiding from? I worry about this with young people. A lot. I worry about the gap between a bajillion likes on social media and zero and how that limits what people will share. I worry about every product being luxury or a piece of crap and that limits what people buy.

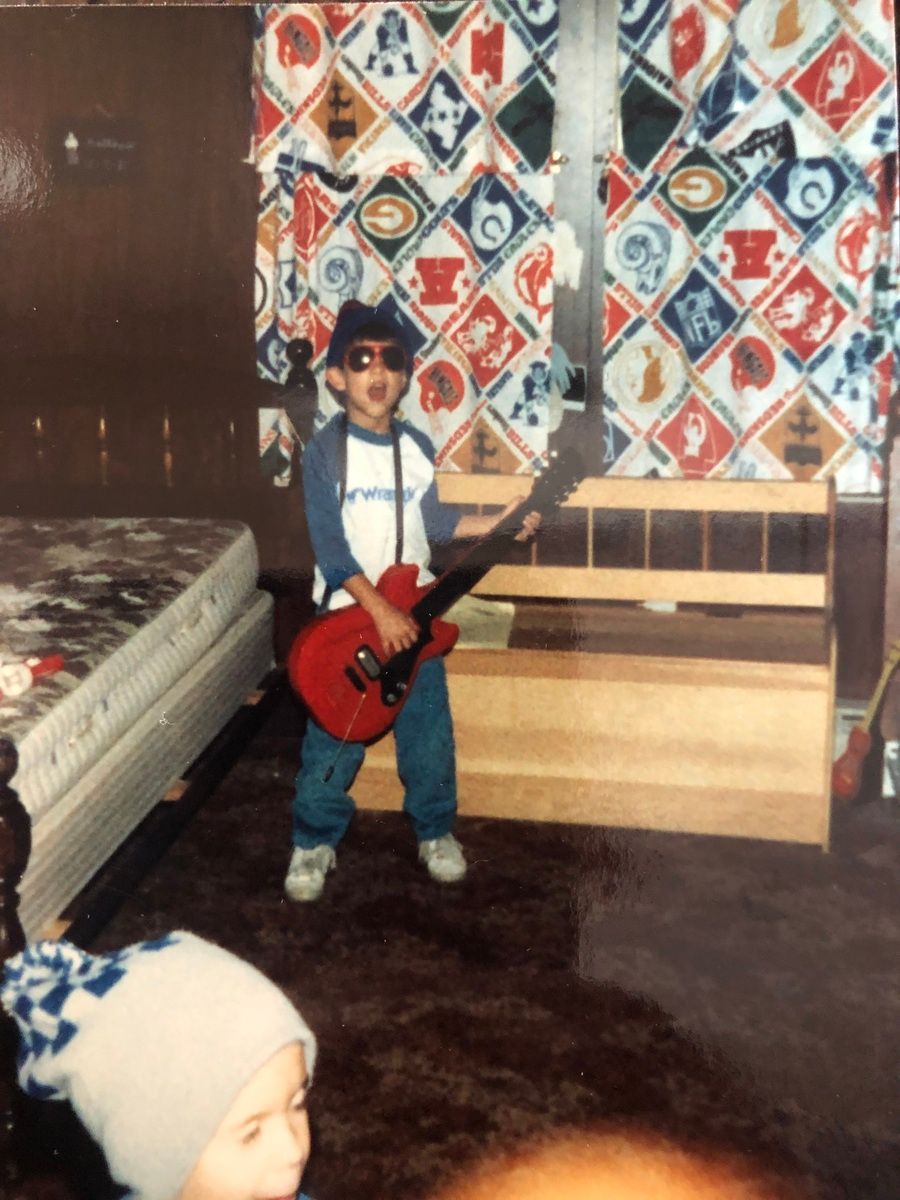

I worry because I grew up taking shots. I grew up being wrong, I got older still being wrong, and I’m hoping to get older yet with a whole lot of egg on my face (and a big dumb smile too). One of the great gifts of life is trying. If you can try and not lose too badly, you have a shot at winning slowly over time, and I worry people are being talked out of it by the non-stop algorithms of modern life.

You don’t have to make bets out of degeneracy. You can make bets out of optimism for a future you want to help create, one frustratingly heavy brick at a time. There’s joy in that.

Life Question For You: What important life decisions are you avoiding because you can't predict the outcome with certainty? How could you make smarter forecasts that acknowledge uncertainty while still enabling action?

LEGACY: Find Points of Agreement Through Nuance

"I can talk to a really hardcore Trump advocate and I can find a point of agreement where I can say, okay, well, you know what? We actually agree that inequality is bad... And so those are the sorts of things that I think people don't do enough of. They just make these blanket statements... and you don't look for any of the nuance in any of this and try to find a point of agreement."

Key Concept: Cullen demonstrates how intellectual maturity involves moving beyond tribal generalizations to find common ground through detailed understanding. Rather than dismissing opposing viewpoints entirely, he seeks the valid concerns underlying different positions. This approach builds bridges and creates space for productive solutions rather than endless debate.

Personal Archive Note-To-Self: Cullen is one of the few macroeconomic thinkers who can simultaneously argue why he doesn’t like tariffs (he likes free markets) and understands why they might somewhat be useful (he likes protecting good jobs for solid reasons).

When we lose the nuance and we just go with whatever team we’re on, we’re not making it better for the whole group. It’s the scarcity pie all over again. The pieces of the pie are the myth - growing the whole thing? We all can contribute. But that means you have to admit the other people aren’t all good or all bad, or all geniuses or all idiots, etc.

If there are many ways to make things better (and therefore many ways to make things worse): keep an open mind - it takes a village and the village is full of all sorts of crazy people, make your own bets - because you get to predict and see what can advance your station, and remember the power of consistent, trusting, and loving relationships - because your people will shape your experiences and ultimately, the meaning in your life.

Life’s hard and short. If you can appreciate the mess we’re all in, you might even appreciate the fun of the mess too.

Legacy question for you: What relationship or disagreement in your life could benefit from you searching for points of agreement rather than focusing on differences? How might leading with curiosity about others' underlying concerns change the dynamic?

BEFORE YOU GO: Be sure to…

Connect with Cullen Roche on Twitter @CullenRoche and LinkedIn

Check out his writing under the Disciplined Alerts tab at disciplinefunds.com

Keep an eye out for his upcoming book "Your Perfect Portfolio" from Harriman House (available for pre-order), and read his prior book, “Pragmatic Capitalism” too!

Seriously, don’t forget to read and follow along to his embarrassing tweets (his words, not mine!)

Take a moment to reflect on all these ideas!

You have a Personal Network and a Personal Archive just waiting for you to build them up stronger. Look at your work, look at your life, and look at your legacy - and then, start small in each category. Today it's one person and one reflection. Tomorrow? Who knows what connections you'll create.

Last thing: Don't forget to click reply/here and tell me who you're adding to your network and why! Plus, if you already have your own Personal Archive too, let me know, I'm creating a database.

ps. my Intentional Investor interview with Cullen is here - we get into his entire career and backstory in detail (it’s fascinating):