For years, I've been connecting with interesting people and documenting insights that might help my clients and myself. What was once private is now (mostly) public.

People often ask: "How do you know all these people?" and "How do you connect these (re: random) ideas?" The answer is simple: consistent relationship cultivation and thoughtful note taking. My north star is trusting my instincts, my maps are the constellations in these reflections.

This approach to multidisciplinary networking has helped dozens of clients, colleagues, and friends strengthen their networks and unlock new opportunities. Find my Personal Archive on CultishCreative.com, watch me build a better Personal Network on the Cultish Creative YouTube channel, and listen to Just Press Record on Spotify or Apple Podcasts, and follow me on social media (LinkedIn and X) - now distributed by Epsilon Theory.

You can also check out my work as Managing Director at Sunpointe, as a host on top investment YouTube channel Excess Returns, and as Senior Editor at Perscient.

Feel free to steal these ideas directly - that's what they're for! I can't promise you'll learn FROM me, but I guarantee you can learn something WITH me. Let's go. Count it off: 1-2-3-4!

Introducing... Rupert Mitchell!

Do you know Rupert Mitchell? He's the founder of Blind Squirrel Macro, a French and Spanish literature major who became one of the most thoughtful macro observers in markets today, and someone who's survived everything from the Barings collapse to building electric cars in China.

If not, allow me to introduce you. Rupert spent decades as an investment banker and derivatives specialist across London, Hong Kong, and Asia before transitioning to independent research and macro commentary. I wanted to connect with him because he embodies something I value deeply: the ability to translate complexity into clarity while maintaining intellectual curiosity across disciplines.

Our conversation is LIVE now on the Epsilon Theory YouTube Channel (and this Cultish Creative Playlist). Listen and you'll hear stories from the trenches of global finance, insights on Chinese capitalism, and why being a generalist might be the ultimate competitive advantage.

THREE: That's The Magic Number of Lessons

In the meantime, I wanted to pull THREE KEY LESSONS from my time with Rupert Mitchell to share with you (and drop into my Personal Archive).

Read on and you'll find a quote with a lesson and a reflection you can Take to work with you, Bring home with you, and Leave behind with your legacy.

WORK: Pattern Recognition Beats Daily Trading

"It's really, really difficult to see the wood from the trees when you're dealing with competitive pressures. ‘Oh my God, is Morgan Stanley gonna win this one off us?’ You know, it's very difficult sometimes to get perspective. And, I've got all the time in the world for perspective these days now, which is fantastic."

Key Concept: The greatest competitive advantage in markets (and business) isn't being in the thick of every battle - it's having the perspective to see patterns others miss. Rupert's transition from investment banking to independent research gave him something invaluable: the ability to observe without the pressure of immediate execution. This distance allows for pattern recognition that's impossible when you're worried about winning the next deal or trade.

Personal Archive Note-To-Self: I like to be a generalist, and I like to have time to think through all my disparate thoughts. That’s why I write. It’s literally what Cultish Creative represents. And, it’s probably also why I appreciate Rupert Mitchell as much as I do (and even more so after this interview).

When he was deep in the deal-flow of his many (MANY) emerging market investment bank type jobs, he got really good at the micro tasks and macro hopping about that he was doing, but it was still hard to disconnect and step back.

And, now that Substack and his own ambitions have given him the ability to step back, what’s emerged is an appreciation for the forest and all the individual trees that only somebody with this much global experience can describe. You have to look closely to find people like Rupert. All the time in the woods has made him - well, squirrelly for one, but also really good at spotting what’s interesting and why.

Work question for you: What perspective are you losing by being too close to your daily battles? How could stepping back help you see patterns others are missing?

LIFE: Embrace Your Inner Generalist

"I celebrate generalism. Last weekend I was writing about feeder cattle. The previous weekend I was writing about SaaS companies. The weekend before that, I was looking at Rice combine harvesters in Japan. You know, I love going anywhere. And I do think that bringing fresh eyes to new situations often gives you an advantage over the people that are in the same sandpit every single day."

Key Concept: In a world that pushes specialization, Rupert champions the power of intellectual curiosity across disciplines. His ability to move from analyzing cattle futures to Japanese agriculture to software companies isn't scattered thinking—it's strategic diversity. Fresh perspectives often reveal insights that specialists, trapped in their expertise, completely miss. The beginner's mind is a powerful competitive advantage.

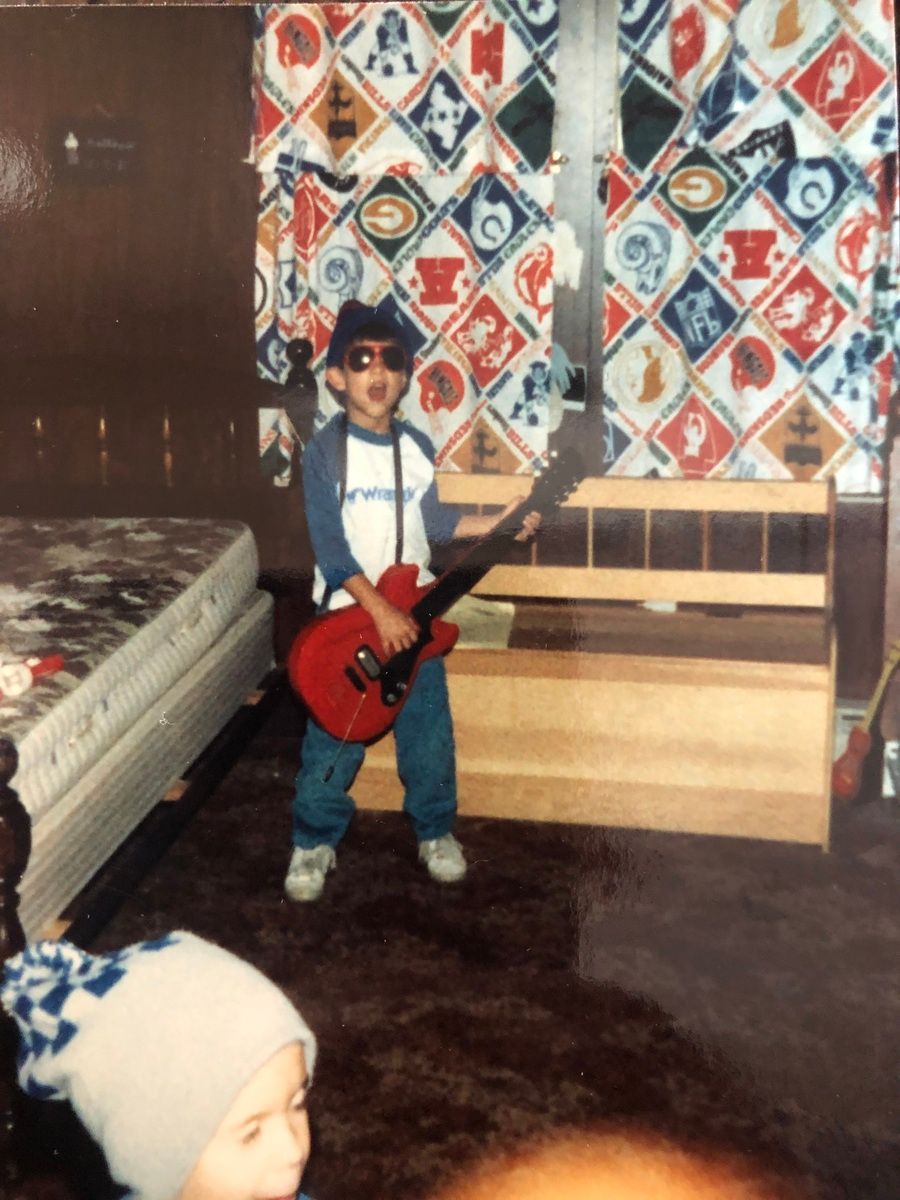

Personal Archive Note-To-Self: For all the years I tried to keep my music nerdery out of my finance job - I’ll never forget the day, probably 10 years ago now, where I got this research report in my inbox titled “3 Feet High and Rising.”

I emailed the lead analyst back, complimented the report, but asked the only thing I really cared about, “Is that a De La Soul reference or a Johnny Cash reference?” To his credit, the lead said, “Ask Tommy, he came up with it.” Yes, it was dismissive, but also, now I knew I had a junior analyst with musical taste.

Tommy told me it was Cash, but he admitted to loving both - and he so appreciated I’d asked that question (because nobody else had). We started a professional friendship over a shared love for these things, and he’d be delighted when I’d be the only one to ping him back after a particularly obscure music nod in a macro research report.

Tommy ended up being one of the most thoughtful analysts I knew. He’s gone on to do other incredible things since. But, I always figured, it was how much non-finance he brought to the table that made him brilliant.

I see that with Rupert, too. It’s about letting your whole self in to play with the ideas, not blocking your own bespoke pattern matching from being part of your professional work. Life is too short to do it any other way. Be weirder.

Life Question For You: What new area outside your expertise could you explore this month? How might that fresh perspective inform your primary work or interests?

LEGACY: Build Skills That Transfer Across Decades

"If you think fundamentally that every job on the planet is sales, waiting tables is a pretty good preparation for pretty much any job on the planet. Someone that's bused tables, someone that's bartended, probably can do sales."

Key Concept: The most valuable skills aren't the technical ones that become obsolete - they're the human skills that transfer across industries and decades. Rupert's insight about restaurant work preparing people for sales (and by extension, investment banking) reveals a deeper truth: understanding how to serve people, handle pressure, and communicate under stress are foundational skills that compound over time. These capabilities become more valuable as technology handles the technical work.

Personal Archive Note-To-Self: Can we just acknowledge that he called kitchen workers “wild animals” a sentence or two after? Sure, the bartenders and busboys, they’re still humans, but those chefs and line cooks and dishwashers, keep those feral creatures in the back please! I’m still laughing about it.

But I’m also in full agreement here. He’s right. Every job is sales. The more experience you get with hospitality and service, the better you are at selling those wares across domains.

I think the real kicker is because in perishable services the stakes are (or can be) lower, all while they’re more personable too. You can be the biggest SaaS b2b salesperson ever but not understand the cantankerous middle-aged man who tells you to take something back to the kitchen six times.

Everybody should read more Danny Meyer. And listen to Rupert. Technical skills are temporary, human skills are eternal.

Legacy question for you: What fundamental human skills are you developing that will remain valuable regardless of how your industry changes? How are you passing these insights to the next generation?

BEFORE YOU GO: Be sure to…

Connect with Rupert Mitchell on Twitter @SquirrelMacro and LinkedIn

Subscribe to Blind Squirrel Macro on Substack for his excellent market commentary

Take a moment to reflect on all these ideas!

You have a Personal Network and a Personal Archive just waiting for you to build them up stronger. Look at your work, look at your life, and look at your legacy - and then, start small in each category. Today it's one person and one reflection. Tomorrow? Who knows what connections you'll create.

Last thing: Don't forget to click reply/click here and tell me who you're adding to your network and why! Plus, if you already have your own Personal Archive too, let me know, I'm creating a database.